workers comp taxes for employers

62 Social Security tax 145 Medicare tax and 09 for anyone who earns more than 200000. In the meantime the IRS expects to see that income on your tax return.

How To Understand Workers Comp Codes In Louisiana Canal Hr

You will not receive any tax documents.

. Additional information on FUTA can be found in IRS Publication 15 Employers Tax Guide. Workers comp laws vary from state to state so it would pay to get legal advice in this situation. However retirement plan benefits are taxable if either of these apply.

Worker compensation insurance or workers compensation insurance or workers comp provides coverage for employees who are injured on the job. There are two ways to provide this coverage depending on the financial resources of your business. Payroll taxes are taxes paid on wages or salaries that employees earn.

I always try to write something on premiums being viewed as a tax this time of year. Internal Revenue Service Workers Compensation Center 400 North 8th Street Box 78 Richmond VA 23219-4838. Workers compensation settlements and weekly payments are not subject to income taxes.

The WCC address is. If you get the full credit your net FUTA tax rate would be just 06 42 plus whatever you owe to your state government. FUTA tax is 6 of the first 7000 you pay each employee during the year.

Call your states workers compensation office and find out what you can do. The subject of a Workers Comp tax comes up each year as today is the end of our tax filing season. Lump sum settlements from workers compensation cases do not count as taxable income either.

However business owners can deduct their workers compensation taxes or payments to cover insurance premiums. Payroll taxes are paid by both employers and employees. If you are currently on workers compensation benefits and do not see a W-2 for the tax year while you were on benefits do not panic.

You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness. Every employer required to be covered by the Workers Compensation Act or who elects to do so and every employee covered by the Act must pay a quarterly fee called the workers compensation assessment fee. In addition to FICA taxes you must also cover unemployment taxes and workers compensation.

An employer is any person corporation or organization for whom an individual performs a service as an employee. But as we noted most workers compensation claims are straightforward affairs. While laws vary by state workers can receive a percentage of pre-tax wages when they get paid from a claim.

Are Workers Comp premiums a tax. Topics within these pages range from obtaining workers compensation insurance to fulfilling employer obligations for state employment security taxes. A workers compensation attorney might suggest you spread out lump-sum payments or shift to Social Security retirement benefits to minimize the offset and avoid tax issues.

The main consideration is how the employer views the payouts. Social Security and Medicare FICA Taxes All US. FICA Federal Insurance Contributions Act is a federal law that requires employers to withhold three taxes from their employees wages.

Employees can usually be distinguished from other types of workers like independent contractors or self-employed individuals based on the work payment terms and relationship they have with their employerGenerally if you offer a. Depending on your state workers compensation class codes are either set by your state workers comp agency or by the National Council on. The fee is similar to a tax and is.

Employers can typically claim the full credit as long as their unemployment taxes are paid in full and on time. Gross wages include all earnings for worked and non-worked time such as paid time off. Even if the employee hasnt given this notice the employer may still be obligated to provide the forms if it knew about the injury.

Since workers compensation benefits are not taxable the Internal Revenue Service does not allow taxpayers to deduct their awards. If you received your workers compensation under a workers compensation act or a statute in the nature of a workers compensation act it is not taxable and they should not have issued you a 1099-MISC. Workers compensation is based on employees gross wages.

Employers must deduct FICA taxes to fund Social Security and Medicare from the paychecks of all employees and remit employer and employee portions of the tax to the IRS. Generally employers must provide workers compensation industrial insurance coverage for their employees and other eligible workers. However you can also claim a tax credit of up to 54 a max of 378.

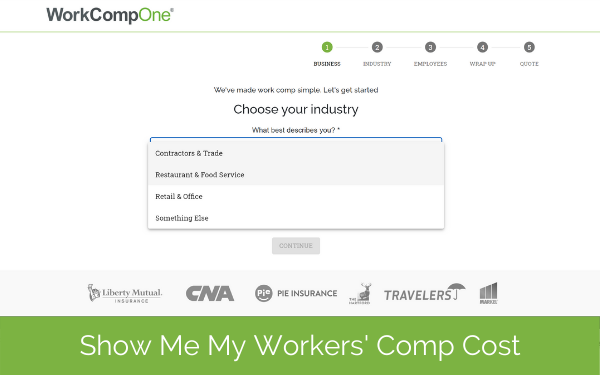

Usually workers compensation benefits will not affect your tax return. Do you claim workers comp on taxes the answer is no. Workers compensation insurance rates depend on the nature of the work performed by the employee and the employers experience rating.

It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel. The Social Security deduction is 62 of gross pay for the employee and 62 for the employer for a total of 124. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them.

Your tax rate is 06 unless your business is in a credit reduction state. Class codes are assigned based on the industry of your business. The injury claim must be completed and transmitted by the WCC to OWCP within 10 working days after the manager receives written notice claim form from the employee.

Most businesses participate in the states workers compensation program. A sole proprietor or partner may elect to obtain workers compensation coverage for an employee who is a spouse parent or child of the owner but coverage for these family employees is not required. State law usually requires that employers carry this insurance.

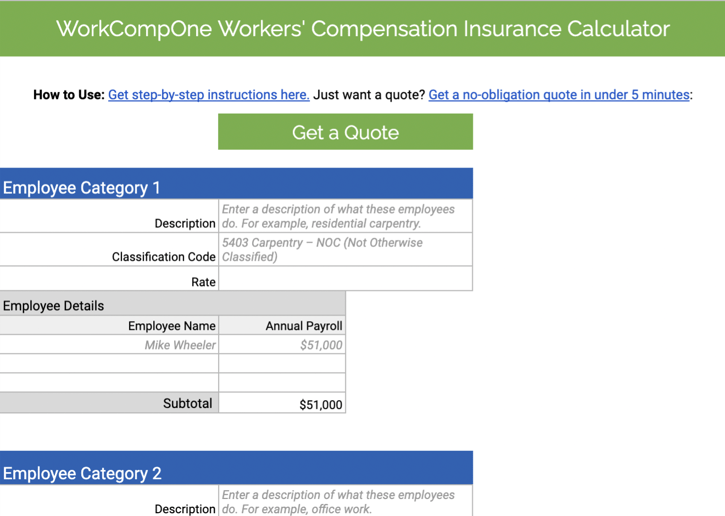

The quick answer is that generally workers compensation benefits are not taxable. The postman just picked up all of our tax forms whew. How to calculate workers compensation cost for an employee in three easy steps.

But most employers receive a FUTA tax credit that lowers their FUTA tax rate to 06 on the first 7000 employees earn. In Washington for example employees receive 60 percent of their gross monthly wages. Typically employers must provide injured employees with a workers compensation claim form within 24 hours after the employee has given notice of an on-the-job injury or work-related illness.

Determine the class code of your employee.

What Wages Are Subject To Workers Comp Hourly Inc

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

How Do I Calculate My Pa Workers Compensation Benefits

Is Workers Comp Taxable Workers Comp Taxes

Fica Taxes Unemployment Insurance Workers Comp For Owners

How To Calculate Workers Compensation Cost Per Employee

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

Workers Compensation Insurance Overview Amtrust Financial

Steps To Take After A Workplace Accident Workplace Accident Worker Workplace

Is Workers Comp Taxable Hourly Inc

Costratesadvisor Com Payroll Analysis Report Workers Comp Insurance Analysis Payroll Taxes

Ssd And Workers Compensation Benefits

How Does Workers Compensation Work In Vermont Sabbeth Law

Fmla Vs Workers Compensation Rules What No One Tells You

5 Requirements For Workers Compensation Eligibility

Permanent Disability Pay In California Workers Comp Cases 2022

How To Calculate Workers Compensation Cost Per Employee Pie Insurance

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

Workers Comp Vs Unemployment Benefits Foote Mielke Chavez O Neil