how much state tax do you pay on a 457 withdrawal

Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. A 50 nondeductible excise tax.

Cash Withdrawal Or Rollover From Your Group Retirement Tiaa Cref

In most circumstances an early withdrawal triggers a penalty equal to 10 percent of the withdrawal amount.

. If you have any questions about the tax consequences of the distribution you are taking from your plan please consult your attorney or tax advisor before the distribution is made. Colorful interactive simply The Best Financial Calculators. Under the Internal Revenue Code you can take money from a 457 early without paying the 10-percent early withdrawal penalty but youll still have to pay taxes on the money.

Use this calculator to see what your net. How do 457b plans work. For example if you withdraw 10000 you must pay your taxes and.

But if youve been saving in a 403b youll take a 10 penalty surtax. Use this calculator to see what your net withdrawal. 800-352-3671 or 850-488-6800 or.

How much tax do you pay on a 457 withdrawal. Connect With An Expert For Unlimited Advice. 404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes.

Are distributions from a state deferred section 457 compensation plan taxable by New York State. If you have a 457 f plan at a private non-profit be prepared for. Get a 457 Plan Withdrawal Calculator branded for your website.

Savings Plus is the name of the voluntary 401 k and 457 b Plans which began in 1974 as a long-term retirement savings program for most State of California employees. Employers or employees through salary reductions. Connect With An Expert For Unlimited Advice.

CA DE OR Stateincome tax withholdingisrequiredwhenfederalwithholding applies unlessyouinstructus not to withhold state income taxes by selecting Do Not Withhold in State. Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. You may not have paid tax on your retirement income but that doesnt mean that your state doesnt tax retirement income under certain conditions.

Retirement income exclusion from 35000 to 65000. Your company gives you the opportunity to defer up to 20 of your compensation over a 10-year period. Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed.

Answer ID 610 Updated 12032019 0853 AM. When you retire or leave your job for any reason youre permitted to make withdrawals from your 457 plan. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

Dont Know How To Start Filing Your Taxes. The organization must be a state or local government or a tax-exempt organization under IRC 501c. Dont Know How To Start Filing Your Taxes.

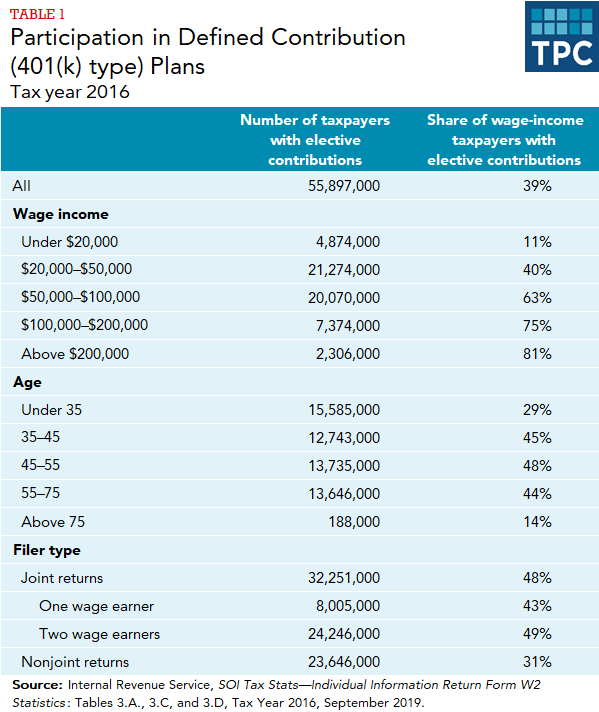

Contributions to a pension or retirement fund are amounts that employees or employers on their behalf pay into funds. 27 states tax some but. Differences Between 457 Plans and.

457 Plan Withdrawal Calculator. If you take the income now you will pay a 37 tax rate on 100000 of income for a. Contributions are usually limited based on the.

Unlike other tax-deferred retirement plans such as IRAs or. Withdrawing money from a qualified retirement account such as a. Theres a hefty penalty for failing to take a required minimum distribution.

Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. If you have a 457b you can withdraw funds from the account without facing an early withdrawal penalty. Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed.

You can withdraw your money from 457 before age 59½ without a 10 penalty unlike a 401k but you will owe taxes on any withdrawal. 5 457 b Distribution Request form 1 Page 3 Federal tax law requires that most distributions from governmental 457 b. Unlike 403 b and 401 k accounts participants can take regular withdrawals from 457 plans as soon as they retire regardless of whether they have reached age 59½.

Retirement Portfolio Withdrawal Requirements Library Insights Manning Napier

Retirement Income Calculator Faq

Distribution In The Form Of A Periodic Automatic Withdrawal Form

Can You Withdraw From Retirement Accounts For Education Disabilities Health Care Financial Planning Retirement Accounts Retirement College Expenses

5 Tax Savvy Retirement Withdrawal Strategies Apprise Wealth Management

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

401k Withdrawal Rules For Home Purchases 2022

What Are Defined Contribution Retirement Plans Tax Policy Center

Retirement Portfolio Withdrawal Requirements Library Insights Manning Napier

401 K Ira Withdrawals Overseas H R Block

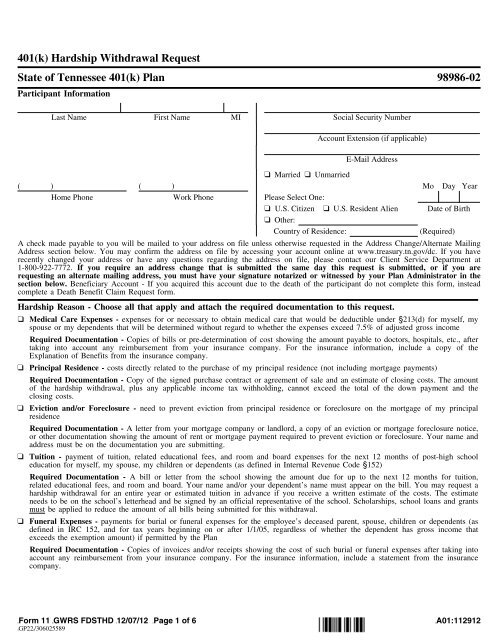

401 K Hardship Withdrawal Request State Of Tennessee 401 K

Distribution In The Form Of A Periodic Automatic Withdrawal Form

Perfect Withdrawal In A Noisy World Investing Lessons With And Without Annuities While In Drawdown Between 2000 And 2019 The Journal Of Retirement

Should You Pay Off Your Home With Retirement Funds Pros And Cons